Scholarship Opportunities Resulting from COVID -19

By Ian Aguilar

COVID-19 discriminates against no business, colleges included. Colleges have been put in a tough place financially and now are scrambling to figure out how to stay afloat in the wake of the pandemic. The financial constraint simply put is an issue of less money coming in and lower desirability for the product. But as the saying goes, “when life gives you lemons make lemonade”. So, let us unpack why this is happening, how it’s happening at different segments of schools, and what scholarship opportunities are resulting from COVID-19 at those schools.

Financial Crisis Within the College Landscape

Schools are being affected differently across the spectrum of colleges but a couple of main themes are consistent across all of them.

1. Refunding costs in relation to the Spring 2020 semester

Schools are refunding varying levels of expenses that families have incurred in this most recent semester towards items from tuition, room & board, etc. Most schools are feeling some pain from refunding these fees -- sometimes to the tune of hundreds of millions of dollars.

A shortlist of schools expecting losses to reach $100 million or more are the University of Wisconsin, Cornell University, University of Michigan, Harvard University, University of Arizona, and much more. The number of schools that make this list continues to grow and could expand even further depending on the progression of the pandemic.

2. Lower Desirability for the Fall 2020 semester and beyond

The price of education has had the luxury of going unchecked for quite some time in our country, yet the actual classroom experience is fairly similar to what it was 50 years ago. Some may even argue that certain colleges have become so large that the quality of education has gone down. Whether or not that argument is valid is not the point here though.

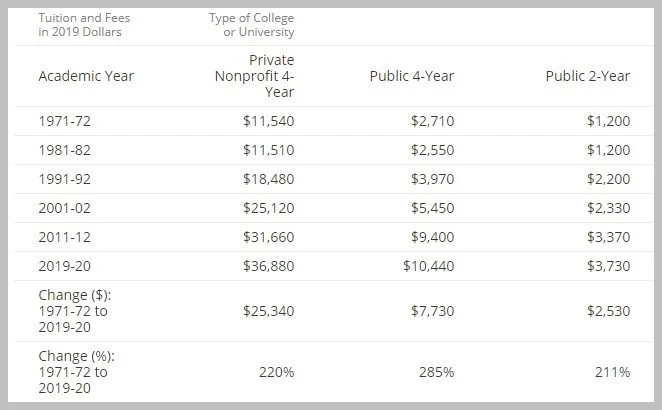

The point is that if college pricing grew at the same pace as inflation then college prices today would only be $11,540 at a Private 4 Year University and $2,710 at a Public 4 Year University. The chart below from BrokeScholar shows that over the last 5 decades colleges have increased their prices at 220% at private universities and 285% at public universities above and beyond the increases already accounted for via inflation.

Before families never scoffed at the idea of these price increases but the new reality has finally caused parents to ask the question “Is what I’m paying for my kid’s college really worth it?”. The truth of it is that many schools are looking to offer their next semester’s education with some watered-down version of their usual classroom experience utilizing on-line learning or other forms of education to supplement or even replace the traditional classroom.

New Realities Across Different Schools

Tier 1 Schools: Your elite colleges and your Ivy league universities. Think about the top of the top.

These schools have monstrous endowments and a powerful name brand to help them weather the storm. They also are feeling the pain in the hundreds of millions of dollars, but they have the ability to dip into their endowments, albeit not to the same extent as many believe since “roughly 80 percent of endowed funds are subject to restrictions designated by the donor”.

Given that these endowments are often in the billions there still is some breathing room there for these colleges. Also, they can expect to be fine with enrollment in the fall since their brand is so powerful that they can easily recruit someone from their waitlist to backfill an empty space should there be any.

Tier 2 Schools: Major state universities and national brand names. Schools you would most likely see compete in football and basketball.

Most large universities do not have near the endowments (although some certainly do) that some of the elite colleges may have. What they do have is the money train associated with big-time sports, mainly college football, to aid in the absence of larger endowment spending.

With college football’s next season looking to be highly affected in the coming school year, there are starting to be more questions around how they may weather the storm. ESPN conservatively estimates that the 65 colleges associated with the power 5 conferences can collectively lose beyond $4 billion in the upcoming season.

We have seen many schools already cut costs via staff, pausing on-campus construction, and hiring freezes. Michigan has an estimated loss of $400 million to $1 billion due to the pandemic! Most losses stemming from refunds, lower football revenue, and lower hospital revenue. They should still be able to keep attendance up due to their large pool of applicants but the reliance on non-student forms of revenue will be this tier’s biggest issue.

Tier 3 Schools: Smaller colleges and universities. Typically, these are more regional in nature and may not be recognized in other parts of the country.

Tier 1 had endowments and tier 2 had sports. What most schools in tier 3 will rely on is their rate of enrollment with students. We already went over the bleak situation surrounding enrollment and the refunding of fees. With estimates surrounding college enrollment expecting as much as a 20% decline, the schools that aren’t able to handle that kind of financial reality will be grasping at straws to fill the financial void. The schools that were already facing admission issues before the crisis may face a harsh acceleration of their pre-COVID situation.

Pinpointing the Right College Opportunities

Tier 1 Schools: Better admission prospects for some.

The ultra-wealthy families that get accepted will still easily pay up and attend in the fall even if it is a virtual experience. The lower-income families will still likely receive the financial aid needed to attend the school, so I do not foresee their attendance changing much. It is the ones who get into these schools from the middle to upper-middle-class families that will have a hard time rationalizing spending over $70,000 to attend college, especially if it’s through online courses.

These are the people who make too much to qualify for financial aid or are only receiving minimal help from their schools. Mom and Dad may not find the cost-benefit trade-off palatable which will probably open some opportunities for other similar students to step up and take their place. You will not get more money but your chances of getting accepted may improve due to certain families saying no thank you.

Tier 2 Schools: Schools willing to bend the rules for out-of-state students.

In terms of attendance, these schools will still most likely be able to “fill” their classrooms, even if those are partly or fully virtual in the fall. The biggest difference though might be the type of student that fills those classrooms as these schools often charge different tuition levels for in-state versus out of state students versus international students.

As families deal with their own financial realities, they may find it economical and safer to keep their kids in-state, which will make it harder for schools to attract talent abroad. Schools will be looking at ways to deal with that dynamic as the past provost from the University of Vermont was quoted saying “We can certainly expect to see more creative and aggressive recruitment strategies, more flexibility in everything from payment plans to semester start-date and length, and to the ability to combine on-campus with online and remote classwork.” You will also find some schools placing tuition freezes so that they do not grow for the time being to stay competitive.

Tier 3 Schools: More money for students. Especially talented students.

This tier is hurting the most and has the most to figure out financially, but it is also where the most opportunity will present itself for students. I would equate this dynamic to value investing where you want to find a discount to buy an education, but want that education to be valuable and fitting to your student so that you gain an exponential return on that education. You also want to avoid the value traps where you buy a cheap education and it proves to be a cheap product.

These value trap schools are the ones that are in a financial vice grip and may not be around in a year or two. As stated earlier, these schools are highly reliant upon student enrolment rates for their revenue streams. Over 82% of revenue comes from tuition and student fees at private schools versus only 38% for larger public universities. Therefore, these schools are going to do everything they can to fend-off a decline in attendance, resulting in discounted rates and being more willing to give money to those students with high merit to keep their schools competitive.

The thing I would caution on for those looking for a great deal is to avoid sinking the cost of admissions to the point where the institution won’t be around in the future. Make no mistake though, this is actually a great opportunity for those looking to attend these kinds of schools. Even if you were not looking at tier 3 schools before, it may beg a second look now.

A Shift in the Power Dynamic

The question around college value has finally had the spotlight shined upon it. The ensuant scramble for colleges to prove their value is creating opportunities for families that did not exist before. It is allowing the power dynamic to be switched around for once, where colleges must fight for their students and revenue.

Some colleges will not make it, and some will probably improve their value proposition through this crisis. The usual rules of college funding still apply, but extra steps are now required, such as reaching out to your respective/prospective financial aid offices at each school and doing further research.

For those that are looking for help beyond the financial aid offices, there is a great website with templates on asking for more financial aid at swift student. Please also feel free to reach out to us as you are looking to strategize around this ever-changing dynamic surrounding COVID-19.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Paragon Wealth Strategies, LLC [“Paragon”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Paragon. Please remember that if you are a Paragon client, it remains your responsibility to advise Paragon, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Paragon is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Paragon’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.wealthguards.com. Please Note: Paragon does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Paragon’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Also Note: IF you are a Paragon client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.