Introductory Overview to Medicare

By Michelle Ash

KEY TAkeaways

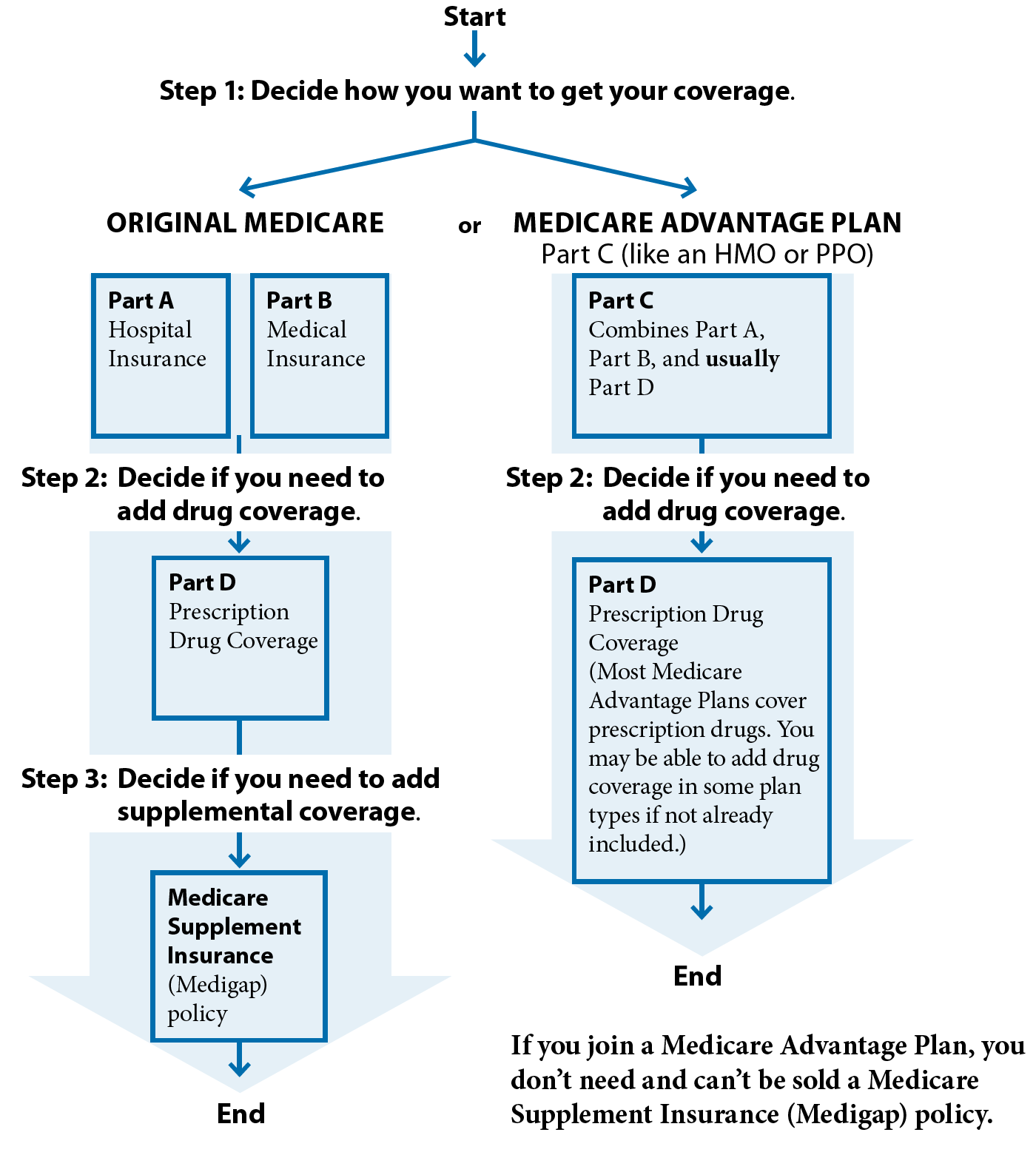

When choosing Medicare, you have two options: Traditional Medicare or Medicare Advantage Plans. Once you choose which Medicare option you would like, it may be difficult to switch from one to the other.

Traditional Medicare has 4 parts: Parts A, B, D and Medigap.

Traditional Medicare does not cover things like dental work, hearing aids, and eyeglasses while Medicare Advantage Plans might include these benefits as well as others.

Choosing the right Medicare plan for you – Traditional Medicare vs. Medicare Advantage – depends on a combination of factors, such as: if you live in more than 1 location, your overall health, and whether you want other ancillary benefits or not.

Welcome to our Medicare Blog Series

Medicare: The United States’ version of universal healthcare for individuals aged 65 and older. Eligibility is a milestone that many retirees are excited to reach. Why? For those who retired prior to age 65, it often means lower costs or more comprehensive benefits. Unfortunately, regardless of age it’s usually also a rude awakening to the complex world of healthcare choices.

This article represents the first article in a blog series about Medicare. In it, our goal is to provide readers with a high-level understanding of how Medicare works, as well as enough information on each of its parts and pieces to figure out how Medicare may fit them best.

Medicare High-level Overview: Original vs Advantage

Reaching Medicare eligibility is like coming to a fork in the road because you must choose which of its two paths to travel. Once you do, it may not be easy to switch from one path to the other, so it’s best to choose carefully.

One path you may travel is that of Original Medicare, also known as Traditional Medicare. Its subcomponents include Parts A for hospital coverage, Part B for medical insurance that covers things like doctor visits and lab work, Part D for prescription drug coverage, and Medicare supplement policies, also known as Medigap, which addresses things otherwise paid out of pocket.

Alternatively, you can choose the path of Medicare Advantage Plans. An Advantage plan feels more like many employer group health benefits because its various parts and pieces are consolidated into one plan. Most Advantage plans wrap in hospitalization, doctor visits, lab work, and prescription drugs. With Advantage plans, you do not need a supplemental Medigap policy.

How Original vs Advantage Differ

In the next several articles in this blog series, we’ll cover important details about each of the parts and pieces of both Original Medicare, as well as Advantage Plans, so readers can become more familiar with each. Before doing that though, it is helpful to understand the big-picture differences between the two paths of Medicare.

Original Medicare generally offers enrollees the ability to use any medical facility and see any physician who accepts Medicare. There are no networks or preapprovals. Monthly costs are generally predictable year by year, with out-of-pocket costs minimized when an individual has all of 4 pieces of Original Medicare (Parts A, B, D, and a supplement). While these can be positive aspects for enrollees, it’s important to know that monthly costs may be higher under Original Medicare than with Advantage plans. Also, the original Medicare path has no coverage for things seniors often need such as dental work, hearing aids, and eyeglasses.

So, in 1999 Medicare Advantage was designed to give Medicare recipients an alternative to the Original Medicare system. The Advantage plans allow commercial insurance companies to offer plans with some flexibility in terms of design and cost to try and make a win/win for the consumer and the company. The insurance companies are given a set sum of money each year for each enrollee in a plan. The plans might include benefits not found in Original Medicare: things like dental, hearing, vision, and maybe even gym membership. After all, the healthier they can encourage members to be, the lower their overall costs, and the more profit the insurance company retains.

In addition to variations in plans, there are potential financial variations for the consumer as well. To compete for participants, many plans offer very low or even $0 monthly cost plans. Many will offer economical copay plans. Does the fact that it can be free with lots of low cost options sound too good to be true? It’s not, as long as you look for where the costs actually exist. One cost may be high out-of-pocket expenditures in the event of a major illness. There are caps to the maximum out-of-pocket spending, but as we’ll see in future articles, these limits are higher under Advantage plans than original Medicare. Also, most Advantage plans have healthcare professional networks. If in-network providers are used, costs remain low. When going out of network, higher costs are likely to apply.

How to Choose Your Path

Each person enrolling in Medicare ultimately must choose the path they want to follow. One interesting fact is that there is no such thing as a family Medicare plan. A married couple must each choose which version of Medicare to elect. They can choose identical coverages if they like, but each is ultimately enrolled separately.

There are situational differences that may help you make your decision quickly. For example, retirees who reside in more than one location throughout the year, or travel abroad extensively, may not get the coverage needed under an Advantage plan. The limitations of each plan will be explored more in future articles.

If those types of differentiators don’t apply, then it might be best to choose based on whether you prefer predictable monthly costs, even if those are a little higher; or minimize overall cost but know that it’s likely to cost more if there’s an “unhealthy year”. Individuals with chronic conditions, or who are high health care users, may find original Medicare to be more cost effective. Those who rarely see a doctor and who are generally healthy might prefer Advantage plans.

The ”Catch” to Be Aware Of

If you’re like me, you might be thinking there’s a workaround to the system, whereby you enroll in an Advantage plan while healthy, so you save money but then switch to original Medicare if major health issues arise. While this sounds great, under most circumstances it won’t work. Why? Because the ability to obtain the Supplement Policy (aka Medigap insurance) that helps offset out-of-pocket costs under original Medicare is only offered with guaranteed insurability during an individual’s initial Medicare enrollment period.

After that, you must prove that you are insurable. An insurance company can request medical history, and ultimately decline coverage, or exclude pre-existing conditions for a period of time. There are certain circumstances when this can be overcome, which will be discussed further in future blog topics. Otherwise, the first path you choose is likely the one you will follow for the rest of your time on Medicare.

Up Next…

Now that we’ve discussed a high-level overview, stay tuned to our next blog where we will uncover more of the details of the different parts and pieces, starting with Medicare Part A: Hospitalization coverage. Prefer not to wait? Watch our Medicare segment from The Retirement Continuum™ class recorded in 2020, here. The numbers are slightly outdated, but the overview and explanations are still applicable today.

Footnotes:

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Paragon Wealth Strategies, LLC [“Paragon”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Paragon. Please remember that if you are a Paragon client, it remains your responsibility to advise Paragon, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Paragon is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Paragon’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.wealthguards.com. Please Note: Paragon does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Paragon’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Also Note: IF you are a Paragon client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.