ACA Subsidies and How a New Retiree Can Maximize Them

By Michelle Ash

This blog post is Part 2 of our discussion about ACA coverage. It focuses on the financial end of things: costs and how some retirees can make their coverage more affordable by strategizing their annual taxable income each year. The Affordable Care Act (ACA) has been an important healthcare option since its inception in 2010. In 2022, enrollment hit an all-time high with 14.5 million consumers purchasing coverage through the ACA federal or state exchanges. For a discussion on the basics of how ACA coverage works and its general pros and cons, please see our previous blog post HERE.

Highlighted in our previous discussion were the high premiums that many consumers pay for ACA coverage, unless they qualify for tax credits from the federal government. These are called subsidies, or advanced premium tax credits (APTCs). Subsidies play a very significant role in helping make coverage affordable. In fact, for 2022 a whopping 89 percent of enrollees qualified for APTCs, according to Health Affairs.org. Prior to subsidies the average monthly premium for all enrollees was $585. Because APTCs covered 86 percent of consumers’ monthly premiums, the average consumer was paying only $111 per month. 1 Clearly this represents a dramatic savings.

Basics to Know About ACA Subsidies and How They’re Calculated

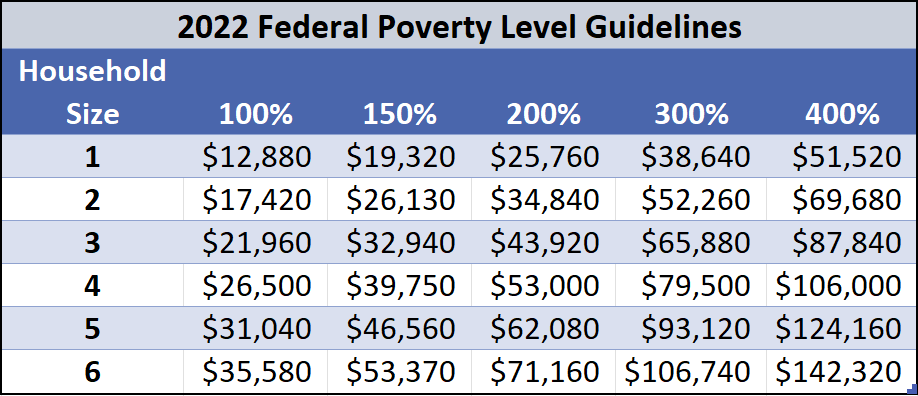

To understand how to maximize subsidies received, first we must understand how subsidies work. The underlying income threshold that subsidies are based on is the federal poverty level (FPL). This is a measure of income, issued annually, by the Department of Health and Human Services. Income below this level qualifies individuals for various federal benefits and programs2. In 2022, for a single person household the FPL is $12,880; for a household of two it’s $17,420. While numbers exist for larger households, this article will focus only on single and two-person households, representing the shape of most pre-Medicare retiree households.

For many retirees, it may be tempting to stop reading at this point, because thinking about the federal poverty level when strategizing how to optimize retirement seems contradictory! Most retirees don’t want to retire and be below the poverty line. Please keep reading; the goal isn’t for a retiree to live on that low of income; it’s just a measure of how subsidies are calculated.

Prior to 2021, to qualify for a subsidy your annual income could not exceed 400% of the federal poverty level. So, using 2022’s numbers for a single person that would be $51,520 ($12,880 FPL x 4), for a family of 2 it’s $69,680 ($17,420 FPL x 4). This income limit is known as the “subsidy cliff”: income below that level would achieve a nice amount of subsidies to reduce monthly premiums; but income above that level would mean NO subsidy help at all.

Why focus on the system from 2020 and earlier? Because in 2021, President Biden signed into law The American Rescue Plan Act (ARPA) as part of the response to the Covid pandemic, which eliminated the subsidy cliff, but only for calendar years 2021 and 2022. The subsidy cliff will return in 2023 unless Congress passes legislation to extend it. So, retirees looking to get subsidies in 2023 and beyond may need to cap their tax-reportable income at or below 400% of the federal poverty level for their household size.

How to Optimize Retiree Income for Achieving Subsidies: Tax-Free Asset Possibilities

The gist of optimizing ACA subsidies is this: retirees don’t have to be poor; they just need to have low income on their tax return. So, how might a retiree do that?

The easiest way to do it is to spend assets you’ve saved that don’t have tax consequences at all in the current tax year, such as cash in the bank. So, if you’ve saved up a nice cushion of cash, spending a portion of it each year can be a great way to keep taxable income low. In fact, don’t overdo it – you need to report at least 100% of the annual FPL to qualify for subsidies; anything below 100% means that you would need to rely on your state’s Medicaid program, if it was expanded under ACA rules.

Another tax-free vehicle that could be tapped are Roth IRAs or employer plan Roth savings. These withdrawals come out tax free if you’ve met all the appropriate tax rules regarding age and account length.

After-Tax Investment Accounts: Capital Gains Taxes Likely Lower than Income Tax Rates

Aside from using tax-free options, after-tax investment accounts are a preferential resource. These assets are typically subject to capital gains tax rates. On long-term assets, which are those held for greater than 365 days, long-term gains are taxed at lower rates than income.

Depending on your taxable income, capital gains will range anywhere from 0% taxation, up to as high as 20% taxation. Income taxes, by comparison, range from 0% to 37% max. Of note, above certain income levels, there may also be an extra 3.8% ‘kicker’ on top of the capital gains rate, in the form of the Net Investment Income Tax.

Still, someone subject to 23.8% taxation instead of 37% is saving over 13% in taxes. Someone subject to 15% capital gains taxation is likely within the 22% (or higher) tax bracket, thus saving at least 7% in taxes.

The other tax-saving opportunity with after-tax accounts is the ability for gains to be offset by losses, either from the current year or a previous tax year that are carried forward. So, sometimes it’s possible to withdraw gains with no taxation!

Income Timing Optimization

Another layer to optimizing income, for the purpose of taking advantage of ACA subsidies, is strategizing the timing of taxable income sources, such as Social Security and pensions. Usually once these benefits are begun, it’s impossible, or at least very difficult (in the case of Social Security) to stop receiving the benefits. So, it’s important to map out which income sources will carry you through age 64, the amount of income, and whether that puts you over the subsidy cliff threshold.

Let’s look at an example.

Bob and Cindy Jones would like to live on $72,000 total income in retirement ($6,000/month). This includes any taxes they need to pay to the federal government or their state for income taxes. In 2022, let’s assume the “subsidy cliff” applies for the sake of this example. In which case Bob and Cindy would make too much money to receive subsidies if all of that is taxable income, since 400% FPL is $69,680. How can Bob and Cindy have their cake and eat it too, or have the lifestyle they want and keep tax-reportable income low enough to avoid a subsidy cliff? By choosing sources of income carefully.

Let’s say that Bob’s Social Security is $2,500/month ($30,000/year). Cindy’s Social Security is $1,500/month ($18,000/year). So, they have $48,000/year of Social Security income. In addition, Bob has a pension providing him $1,000/month ($12,000/year). Combined with Social Security, this accounts for $60,000 of their annual income need.

What about the other $12,000 per year they want to live on? They can either come from a) their bank savings with a balance of $50,000, or b) an IRA also worth $50,000. The clear choice is to draw from their bank savings because their total taxable income will remain at $60,000. However, if they use the IRA, tax-reportable income for subsidies will be $72,000 and they would be disqualified under subsidy-cliff rules. Taking it a step further, they also could use a combination of bank savings and IRA withdrawals, as long as they stayed below the $69,680 income cap.

What kind of subsidy help does this potentially provide? According to the Kaiser Family Foundation’s Health Insurance Marketplace Calculator3 for 2022, at $60,000 of income, Bob and Cindy would qualify for $1,612/month of subsidy, which adds up to $19,347 per year. This is estimated to cover 82% of the monthly cost.

Their cost for a Silver plan is $356/month, for a total of $4,266 per year. Without help from subsidies, or APTCs, their cost would be $1,968/month, or $23,613 per year.

So, just by being aware of their income tax level for the year, and which piece of their nest egg they spend, they can qualify themselves for over $19,000 of financial assistance from the government!

As mentioned, once 2023 rolls around, if Congress hasn’t expanded the help provided by ARPA, this will be a critical money-saving strategy for retirees to employ.

Additional Resources:

Footnotes/Sources:

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Paragon Wealth Strategies, LLC [“Paragon”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Paragon. Please remember that if you are a Paragon client, it remains your responsibility to advise Paragon, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Paragon is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Paragon’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.wealthguards.com. Please Note: Paragon does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Paragon’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Also Note: IF you are a Paragon client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.