A Healthcare Choice Available to Every Pre-Medicare Retiree: Affordable Care Act (“ACA”) Coverage

By Michelle Ash

The seventh and final option of healthcare coverage we’ll be discussing in our Pre-Medicare blog series is the one that’s available to every pre-Medicare retiree: coverage through the Affordable Care Act (“ACA”) laws. This law recently celebrated its 12th anniversary on March 23, 2022. Regardless of politics, it’s fair to say this law significantly changed the landscape for retirees by eliminating the need to remain working until employer healthcare coverage could bridge the gap to Medicare. Now, regardless of age of retirement, a healthcare choice exists. However, whether you find it to live up to the “affordable” part of its name, might be another matter entirely.

Our discussion on the ACA coverage is going to be split up into two blog posts, because it’s a meaty subject. First, in this article, we’ll discuss an overview of the ACA system and things to consider if you are considering this coverage. Then, in our next post, we’ll put financial strategy to work by looking at one component of the ACA system – premium subsidies – and discuss how to optimize income to better take advantage of subsidies that reduce your out-of-pocket costs for monthly premiums.

ACA Coverage Basics

The Affordable Care Act established a marketplace for healthcare in each state, by requiring each state to either offer their own health insurance exchange or use the federal marketplace. In 2022, 33 states use the federally run exchange which is found on www.healthcare.gov. The other 17 states and the District of Columbia run their own exchanges.

Consumers use the exchange to shop for a healthcare plan of their choice. Generally speaking, coverage runs on a calendar year basis, with open enrollment occurring annually from early November through mid-December for coverage to start on January 1st of the following year.

If you don’t purchase coverage during open enrollment, you may still be able to buy ACA coverage if you have a special qualifying event, which includes things like the loss of your job or existing coverage, moving to a new coverage area, or a family event like marriage, divorce, or death.1

The healthcare coverage plans will vary, but the ACA law made some provisions mandatory for all plans. This includes access to coverage without underwriting, regardless of pre-existing conditions. Additionally, insurance companies cannot charge a person more in premiums because of their health circumstances. The only criteria that insurance companies can use to price premiums are an individual’s age, location, tobacco use, and whether the plan covers dependents. All plans are also required to cover 10 essential health benefits including hospitalization, emergency services, maternity, mental health, preventive services, and pediatrics, to name a few.

Plans, and their costs, will also vary by the type of network of care providers it makes available. Some plans are structured as an HMO or PPO, with certain preferred physicians and service providers considered in-network, and others being out of network and costing more out of pocket. Other plans may allow you to use almost any doctor or healthcare facility.2 So, one important tip when choosing an ACA plan is to make a list of any physicians you consider essential to your care, and make sure they are covered by the plan you choose. Online plan information will usually help you find an index of in-network providers.

Plan Structure and Costs

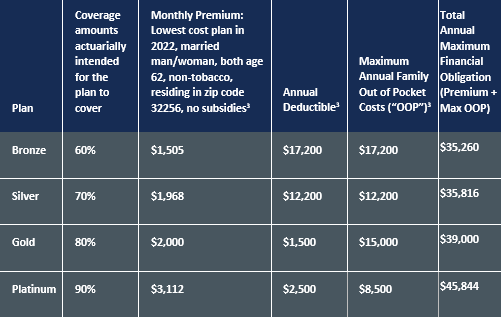

The plans of coverage available under the ACA are generally arranged into four “metal” categories: bronze, silver, gold, and platinum. The critical thing to understand about the structure of these plans is that financially, they operate a little bit like a seesaw. Plans on the ‘lower’ end of the metal spectrum, or bronze plans, are going to have a lower monthly premium, but higher deductibles and total out-of-pocket maximums. Plans on the ‘higher’ end of the metal spectrum, or platinum plans, will have higher monthly premiums, but lower deductibles and out-of-pocket costs.

The idea behind plan pricing is that someone who wants to have coverage but may generally be healthy and not go to the doctor very much might prefer a plan with a cheaper monthly premium, knowing they may spend more when health events occur. On the other end of the seesaw, sits someone who may have pre-existing conditions, chronic care needs, or prefers a higher monthly premium so that unexpected costs are limited. This is easy to see and understand in a table.

I want to stop here for a moment and acknowledge that some readers might have just done a double-take, wondering if there was a decimal point that was missing from the figures in the chart. Unfortunately, no, the monthly premiums and total costs you see are accurate. Keep in mind, too, that the monthly premiums will be paid regardless of whether any healthcare needs occur in that calendar year. The only offset to these shocking prices that I’ll mention is that I’ve chosen to represent two individuals, both of whom are reasonably close to Medicare eligibility, which begins at age 65 under most circumstances. With ACA coverage, the older one gets, the more expensive it is. So, if you’re reading this blog entry and you are significantly younger than age 62, then your premiums are likely to be a good bit lower. For perspective, the healthcare.gov website shares lowest-cost plans for a 35-year-old as $410/month for a bronze plan, and $875/month for a Platinum plan.4

This chart probably helps to explain why the biggest criticism of the ACA healthcare is that, while it provides access to healthcare, its options aren’t necessarily affordable. Keep reading to get some relief from your sticker shock.

Subsidies: What They Are and How they Help Offset High Premiums

For many Americans, the good news is that there’s financial help that reduces the monthly premiums shown in the previous table. Under ACA, these are called “subsidies” and are tax credits from the federal government that help to offset monthly premiums, serving to reduce, or even eliminate, monthly premium costs.

Subsidies are calculated at the start of a plan year with the application for coverage, via the financial information the individual files with the health insurance company. They are based on an individual’s estimated taxable income for the upcoming year. If an individual qualifies for subsidies, then the health insurance company will receive directly from the government the monthly amount of the estimated subsidy. The individual pays the difference to the insurance company each month.

At the end of the year, via the individual’s federal tax return, actual income is reported, and actual subsidy is determined. If the individual should have paid more, then they’ll likely owe it through their tax return. If the subsidy should have been larger, then a tax refund may be received (all other things being equal).

Since subsidies are income based and not based on net worth, retirees who have saved up a nice nest egg shouldn’t automatically assume they’ll be disqualified from subsidies. In fact, in our next blog post, we’ll look at financial details around subsidies, and discuss how to position one’s income to maximize the opportunity for an ACA subsidy.

So, until next time, feel free to visit our video recording on all the pre-Medicare healthcare options, found here. Or stay tuned for our next blog post!

Additional Resources:

Footnotes/Sources:

1 https://www.ehealthinsurance.com/resources/affordable-care-act/understanding-obamacare 2 https://www.healthcare.gov/choose-a-plan/comparing-plans/ 3 Online quotes using www.healthcare.gov on 4/8/2022 for criteria mentioned in table. 4 Healthcare.gov for zip code 32256.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by Paragon Wealth Strategies, LLC [“Paragon”]), or any non-investment related content, made reference to directly or indirectly in this blog will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice from Paragon. Please remember that if you are a Paragon client, it remains your responsibility to advise Paragon, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. Paragon is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of the Paragon’s current written disclosure Brochure discussing our advisory services and fees is available for review upon request or at www.wealthguards.com. Please Note: Paragon does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to Paragon’s web site or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Please Also Note: IF you are a Paragon client, Please advise us if you have not been receiving account statements (at least quarterly) from the account custodian.